$67,500 Loan - Israa Ali 2023

Jenkins & Sylvester receive $50,000 loan in July 2023 from Israa Ali, titled "Factoring securitization of SBA loan #3247847898". Life Insurance Policy noted as the security agreement. Additional $17,500 loan given in August 2023. Guarantee noted as personal and by businesses: Graze Craze Inc., Graze Craze Franchising Partners LLC, Matrix Fulfillment LLC, Fostering Lyfe LLC, Out Front Consulting LLC.

$67,500 Loan - Israa Ali 2023

$50,000 Promissory Note, July 22,2023

$50,000 Promissory Note, July 22,2023

$50,000 PROMISSORY NOTE

Factoring securitization of SBA loan #3247847898

$50,000

July 22, 2023

FOR VALUE RECEIVED, the undersigned, GRAZE CRAZE, INCORPORATED, an Oklahoma corporation¹ (hereinafter referred to as “Borrower”), hereby promises to pay to the order of (name of individual or company) Israa Ali (hereinafter referred to as “Lender”), at the following address: [redacted], or at such other place as the Lender may from time to time designate in writing, the principal sum of Fifty thousand and 00/100 Dollars,

($50,000.00) (Example amount for illustration purposes, amount may be any amount acceptable by borrower) according to the terms of this Promissory Note (the “Note”) together with interest on the principal balance hereof from time to time existing at the following per annum rate, to wit:

100 Percent (100%)

All agreements between Borrower and Lender are expressly limited so that in no contingency or event whatsoever, whether by reason of advancement of the proceeds hereof, acceleration of maturity of the unpaid principal balance hereof, or otherwise, shall the amount paid or agreed to be paid to Lender for the use, forbearance or extension of the money to be advanced hereunder exceed the highest lawful rate permissible under applicable law. If, from any circumstance whatsoever, fulfillment of any provision hereof or of the Security Instrument, at the time performance of such provision shall be due, shall involve transcending the limit of validity prescribed by applicable law, then, ipso facto, the obligation to be fulfilled shall be reduced to the limit of such validity, and, if from any circumstance Lender shall receive as interest an amount which would exceed the highest lawful rate allowable under applicable law, such amount which would be excessive interest shall be applied to the reduction of the unpaid principal balance due hereunder and not to the payment of interest or, if such excessive interest exceeds the unpaid balance of principal, the excess shall be refunded to Borrower. This provision shall control over every other provision of all agreements between Borrower and Lender.

Principal and interest hereunder shall be payable in the following manner:

Borrower shall pay to Lender the amount due under this Note in one lump sum of all outstanding principal and interest (collectively, One hundred thousand and 00/100 Dollars ($100,000), on the earlier of (i) on the earlier of August 1, 2024 (the “Maturity Date”), which is the one year anniversary following the effective date of this Note

Borrower shall have the right to prepay the principal and interest due under this Note without penalty; provided, however, the interest due shall not abate to the prepayment date and instead such prepayment shall include all interest which would have been accrued under this Note had the prepayment not been made prior to the Maturity Date. For example, should Borrower prepay the amounts due under this Note on any such date prior to Maturity Date, then Borrower shall pay Lender One hundred thousand and 00/100 Dollars ($100,000.00).

1. Applicable Interest Rate.

Interest accruing to the principal sum of this Note shall be calculated as a simple interest rate. The term “Applicable Interest Rate” as used in this Note shall mean, from the date of this Note through and including the Maturity Date, a rate of Seventy Percent (1001%) of the principal amount.

2. Application.

All payments on this Note shall be applied at any time and from time to time in the following order:

(i) the payment or reimbursement of expenses (including but not limited to late charges), costs or other obligations (other than the principal hereof and interest hereon) for which Borrower shall be obliged or Lender entitled pursuant to the provisions hereof or of the Security Instrument,

(ii) the payment of accrued but unpaid interest hereon,

(iii) the payment of unpaid escrow amounts required herein, in the Security Instrument, and

(iv) the payment of all or any portion of the principal balance then outstanding hereunder, in either the direct or inverse order of maturity, at Lender’s option.

3. Prepayment Penalty.

Borrower shall have the right to prepay at any time without penalty; provided, however, the interest due shall not abate to the prepayment date and instead such prepayment shall include all interest which would have been accrued under this Note had the prepayment not been made prior to the Maturity Date.

4. Security; Guaranty.

This Note, and the obligations set forth herein, is secured by that certain asset of Borrower, as more specifically set forth in that certain Security Instrument executed by Lender simultaneously with this Note. The term “Security Instrument” as used in this Note shall mean the instruments executed and delivered by Borrower contemporaneously with this Note collateralizing that certain Farmers Insurance Group term life policy. Moreover, this Note is guaranteed by that certain Guaranty Agreement of even date herewith executed by Kerry Sylvester and J.A. Jenkins, jointly and severally (each, a “Guarantor”).

5. Default. An “Event of Default” shall occur if:

a. Borrower fails to make the full and punctual payment of any amount payable hereunder or under the Security Instrument;

b. Borrower fails to pay the entire outstanding principal balance hereunder, together with all accrued and unpaid interest, on the date when due, whether the Maturity Date, upon acceleration or prepayment or otherwise;

c. The death, dissolution or insolvency of, appointment of a received by or on behalf of, application of any debtor relief law, the assignment for the benefit of the creditors by or on behalf of, the voluntary or involuntary termination of existence by, or the commencement of any proceedings under any present or future federal or state insolvency, bankruptcy, reorganization, composition or debtor relief law by or against Borrower or any co-signer, endorser, surety or either Guarantor of this Note or any other obligations Borrower has with Lender;

d. Borrower fails to perform or keep any promise or covenant of this Note;

e. Borrower makes any verbal or written statement or provides any financial information that is untrue, inaccurate, or conceals a material fact at the time it is made or provided;

f. Borrower is in default on any other debt or agreement Borrower has with Lender;

g. Borrower fails to satisfy or appeal any judgment against Borrower;

h. Borrower changes its name or assumes an additional name without notifying Lender in advance of making such change;

i. Borrower transfers all or a substantial part of Borrower’s money or property;

j. Borrower experiences a material change in its business, including ownership, management, or financial conditions without first notifying Lender;

k. The merger, dissolution, reorganization or termination of Borrower’s business, or a partner or majority owner in such business dies or is declared legally incompetent;

l. Property pledged in the Security Instrument to secure payment of this Note is used in a manner or for a purpose that threatens confiscation by a legal authority or is transferred by any means to any other person or entity, except in the case of a transfer to the Lender or to a person or entity with the prior written approval of Lender; or

m. An Event of Default (as defined in the Security Instrument) has occurred under the Security Instrument.

6. Acceleration.

The whole of the Debt, including without limitation, the principal sum of this Note, all accrued interest and all other sums due under this Note, and Security Instrument, shall become immediately due and payable at the option of the Lender, without notice, at any time following the occurrence of an Event of Default.

7. Default Interest.

Upon the occurrence of an Event of Default (including without limitation, the failure of Borrower to pay the Debt in full on the Maturity Date), Lender shall be entitled to receive and Borrower shall pay interest on the entire principal balance at the rate (the “Default Rate”) equal to ten (10%) percent above the Applicable Interest Rate. The Default Rate shall be computed from the occurrence of the Event of Default until the actual payment in full of the Debt. This charge shall be added to the Debt, and shall be deemed secured by the Security Instrument. This clause, however, shall not be construed as an agreement or privilege to extend the Maturity Date.

8. Attorney Fees.

In the event the Lender employs attorneys to collect the Debt, to enforce the provisions of this Note or to protect or foreclose the security hereof, Borrower agrees to pay Lender’s attorney’s fees and expenses, whether or not suit is brought. Such fees and expenses shall be immediately due and payable.

9. No Amendments.

This Note may not be modified, amended, waived, extended, changed, discharged or terminated unless all parties agree in writing.

10. Assignment.

Lender, and its successor, endorsees and assigns, may freely transfer and assign this Note. Borrower shall not have the ability to transfer its rights and obligations with respect to the Note, unless approved in writing by the Lender.

11. Applicable Law; Jurisdiction.

This Note shall be governed and construed in accordance with the laws of the State of Oklahoma, without regard to its conflict of laws provisions. Borrower hereby submits to personal jurisdiction in the state courts located in said state and the federal courts of the United States of America located in said state for enforcement of Borrower’s obligations hereunder and waives any and all personal rights under the law of any other state to object to jurisdiction within such state for the purposes of any action, suit, proceedings or litigation to enforce such obligations of Borrower.

12. Waiver of Presentment, Etc.

Borrower and all others who may become liable for the payment of all or any part of the Debt do hereby jointly and severally waive presentment and demand for payment, notice of dishonor, protest, notice of protest, and notice of intent to accelerate the maturity hereof (and of such acceleration), except to the extent that specific notices are required by this Note or the Security Instrument.

13. No Waiver.

Any failure by Lender to insist upon strict performance by Borrower of any of the provisions of this Note or the Security Instrument shall not be deemed to be a waiver of any of the terms or provisions of this Note or the Security Instrument, and Lender shall have the right thereafter to insist upon strict performance by Borrower of any and all of the terms and provisions of this Note or the Security Instrument.

14. Notices.

Except as otherwise specified herein, any notice, consent, request or other communication required or permitted to be given hereunder shall be in writing, addressed to the other party as set forth below (or to such other address or person as either party or person entitled to notice may by notice to the other party specify), and shall be (a) personally delivered; (b) delivered by Federal Express or other comparable overnight delivery service; or (c) transmitted by United States certified mail, return receipt requested with postage prepaid to:

IF TO BORROWER:

Graze Craze, Inc.

720 N. Main Street

Newcastle, Oklahoma 73065

Unless otherwise specified, all notices and other communications shall be deemed to have been duly given on the first to occur of actual receipt of same or:

(i) the date of delivery if personally delivered;

(ii) one (1) business day after depositing the same with the delivery service if by overnight delivery service; and

(iii) three (3) days following posting if transmitted via United States certified mail.

15. Other Defined Terms; Incorporation by Reference.

All amounts due and payable under this Note, together with all sums due under the Security Instrument, including all applicable attorney fees and costs, are collectively referred to herein as the “Debt.” Where appropriate, the singular number shall include the plural, the plural shall include the singular, and the words “Lender” and “Borrower” shall include their respective successors, assigns, heirs, personal representatives, executors and administrators.

16. Severability.

If any term, covenant or condition of this Note is held to be invalid, illegal, or unenforceable in any respect, this Note shall be construed without such provision.

17. Time of the Essence.

Time shall be of the essence in the performance of all obligations of Borrower hereunder.

IN WITNESS WHEREOF, Borrower has duly executed this Promissory Note to be effective the day and year first written above.

[GRAZE CRAZE INCORPORATED]

GUARANTY AGREEMENT

FOR VALUABLE CONSIDERATION, receipt of which is hereby acknowledged, Kerry Sylvester and J.A. Jenkins, jointly and severally (collectively, the “Guarantor”) hereby unconditionally and irrevocably guarantees the full and faithful performance by Borrower (as hereinafter defined) of all the terms, covenants and conditions of that certain Promissory Note of even date herewith between GRAZE CRAZE, INCORPORATED, an Oklahoma corporation (hereinafter referred to as “Borrower”) and ____________ (_____, an individual (hereinafter referred to as “Lender”) (the "Note").

The Lender may, at the Lender’s option, proceed to enforce this Guaranty directly against the Guarantor without first proceeding against the Borrower or any other person liable for payment or performance under the Note and without first proceeding against or exhausting any collateral now or hereafter held by the Lender to secure payment or performance under the Note.

The Guarantor waives diligence, presentment, protest, notice of dishonor, demand for payment, notice of nonpayment or nonperformance, notice of acceptance of this Guaranty and all other notices of any nature in connection with the exercise of the Lender’s rights under the Note or this Guaranty.

This Guaranty is delivered in the State of Oklahoma and shall be construed according to the laws of Oklahoma and shall inure to the benefit of and be enforceable by Lender, and shall be enforceable against and binding upon Guarantor and Guarantor’s successors and assigns. The exclusive venue for all disputes arising out of this Guaranty shall be in the courts of the State of Oklahoma. In the event that this Guaranty is pursued through any legal action, the prevailing party shall be entitled to recover attorney’s fees and costs, inclusive of appellate, collection attorney’s fees and costs, and litigation related to “fees for fees.”

Guarantee is to include all applicable personal guarantee as well and any and all business entities owned whole or in part by either of the two borrowers to include but not limited to:

Graze Craze Inc.

Graze Craze Franchising Partners LLC

Matrix Fullfillment LLC

Fostering Lyfe LLC

Out Front Consulting LLC

IN WITNESS WHEREOF, Guarantor has duly executed this Guaranty to be effective as of June 5, 2023.

By: J.A. Jenkins

$17,500 Addendum Aug 18, 2023

Factoring securitization of SBA loan #3247847898

For value received Graze Craze Incorporated and Israa Ali

This document is to serve as increased investment to contract dated July 22, 2023

For the part of second party the increase of $17,500 in addition to original principal investment amount of $50,000

A total investment of $67,500 and agreed amended payment schedule as follows.

Original principal and interest of original investment total deferred payment until 6 months balloon payment on sixth month of $100k

Additional payment of $17,500 principal investment in addition to original principal investment of 50k will allow for a 20% payment monthly for 6 consecutive months of interest only of $13,500.

Payment schedule as follows: payment on or about

Oct 1 2023 – $13,500

Nov 1 2023 – $13,500

Dec 1 2023 – $13,500

Jan 1 2024 – $13,500

Feb 1 2024 – $13,500

March 1 2024 – $13,500

Balloon payment of original principal and interest

March 1 2024 – $100,000

This agreement is an addition to and supersedes all prior agreements in effect to payment schedule principal and interest. This is the entire agreement.

[Signatures]

Loan PDF

Addendum

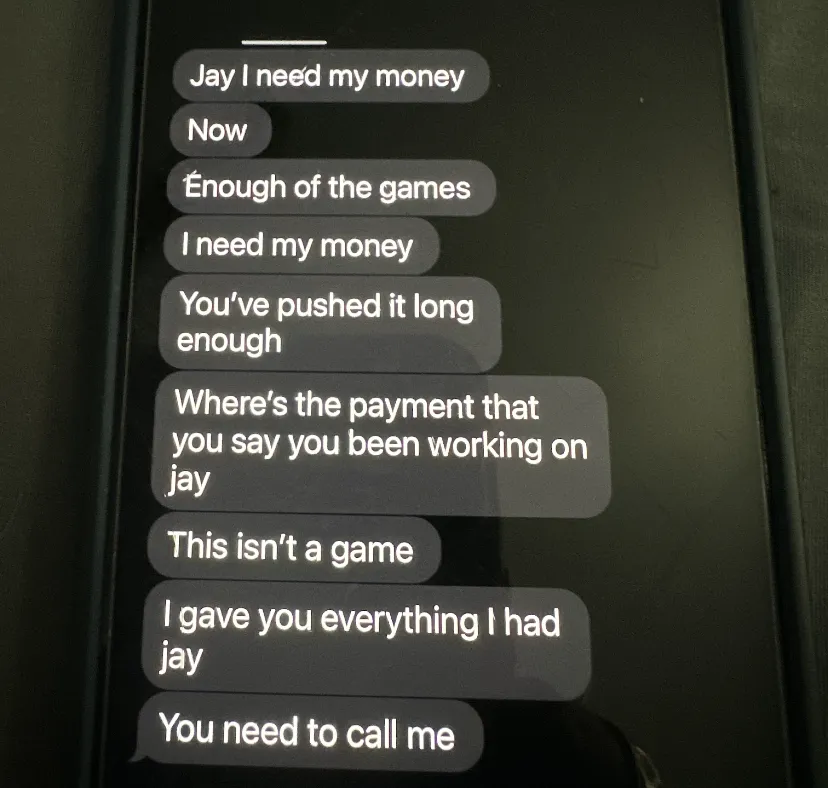

2025 text messages asking for money back

People Connected by Address

Of the phone numbers Jenkins pays for, 405-906-8435 lists Legacy Publishing as the User. The phone number is also connected to Mahdi Ali, who is related to Hawraa Ali (a previous girlfriend of Jenkins) and Israa Ali. All 3 individuals have shared the same address.

In addition to Hawraa Ali dating Jenkins in the past, her brother is Muhammad (Moe) Ali. Moe's number is listed on the AT&T bill as well, 405-513-0205. Moe worked for Jenkins as one of his Oklahoma Graze Craze locations, and lived with Jenkins at his and Sylvester's home in Newcastle.

Israa Ali is 30 years old and was born in May 1995. She's lived at 3541 NW 52nd St in Oklahoma City, OK since September 2020. She can be reached at (405) 638-8779, a mobile number through T-Mobile.

(405) 982-9689 - Wireless

Possible Primary Phone

Last reported Jun 2025

T-Mobile