$671,000 Loan - Daniel Zier 2022

$671,000 Loan - Daniel Zier 2022

$671,000 Loan Agreement between Daniel Zier (Captain Dan), James Adam Jenkins & Kerry Sylvester

Photos: Signed Loan Agreement, 3 Pages

$671,000 Loan Agreement between Daniel Zier (Captain Dan), James Adam Jenkins & Kerry Sylvester

Business mentions: Matrix Fulfillment LLC, Graze Craze Incorporated, Tightline Investments LLC

Agreement Date: 12/07/2022

Agreement states Matrix Fulfillment LLC (the "Borrower") received $671,000.

Summary

The agreement outlines a loan of $671,000 issued to Matrix Fulfillment LLC, with a total repayable principal of $780,000, plus 10% annual interest, calculated on a 365-day year. Repayment is due monthly according to an amortization schedule, with payments applied first to interest and then to principal.

It is secured pursuant to a Loan, Security, and Exclusive Supply Agreement entered between the borrower, its affiliated parties, and the lender, which includes rights to business assets of GC Franchisee such as credits, claims, demands, proceeds, and other personal property (e.g., farm products, consumer goods, insurance claims, or payments due to the franchisee).

Repayment is personally guaranteed by Kerry L. Sylvester and J.A. Jenkins, under a joint and several Personal Guaranty. The guarantee includes two life insurance policies underwritten by agent Tolbert Corley, designated to provide immediate payment to the lender upon the death of one or both guarantors. Kerry Sylvester passed away in December 2024. Life Insurance proceeds were not paid to Daniel Zier.

The loan’s stated use is not specified, but the structure (secured by business assets, with convertible equity and franchise-related collateral) strongly implies it was intended to fund operations or expansion of Matrix Fulfillment LLC and/or affiliated Graze Craze franchise entities.

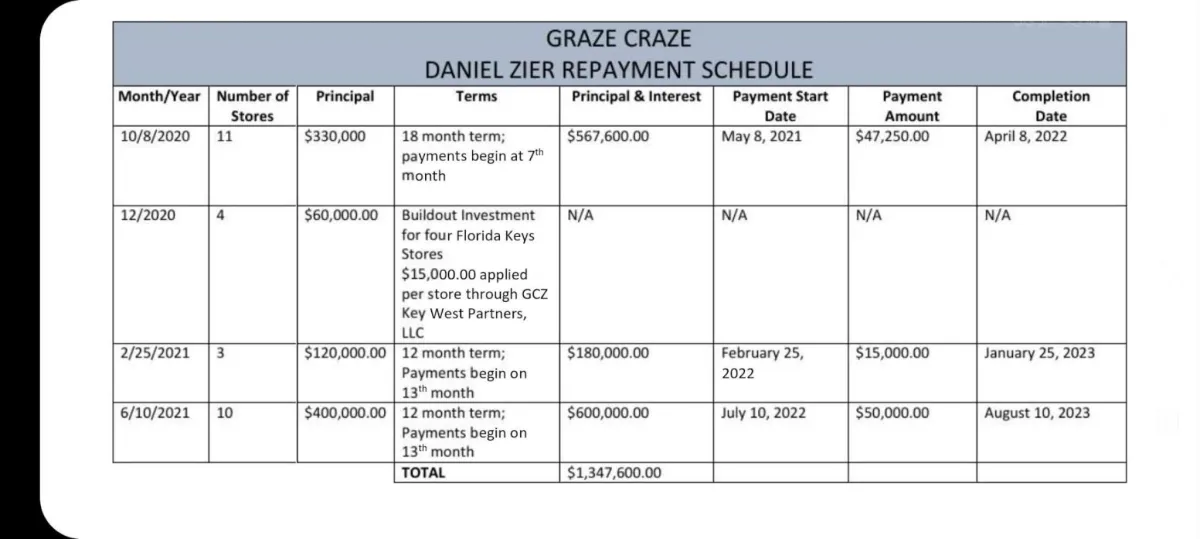

A separate repayment schedule labeled “Graze Craze – Daniel Zier Repayment Schedule” outlines principal loans tied to the buildout of 28 stores between 2020 and 2021.

These include 11 stores funded with $330,000 in October 2020, 4 stores in the Florida Keys with a $60,000 buildout loan in December 2020, 3 stores backed by a $120,000 loan in February 2021, and 10 stores funded with a $400,000 loan in June 2021.

These details suggest the promissory note is connected to a broader financing structure that supported the expansion of Graze Craze franchise locations, even if the note itself does not explicitly enumerate them.

Loan Outline

Loan Amount:

$671,000 issued

$780,000 principal + 10% interest, due per attached amortization schedule

Total repayable over time: ~$1,271,400

Interest Rate:

10% per annum, calculated on a 365-day year, paid monthly

Repayment Terms:

Payments applied first to interest, then principal

No prepayment without lender’s written consent

Conversion Option:

Lender can convert debt to equity (up to 63% ownership) at any time during the note term

Conversion requires surrender of the note and a signed Joinder Agreement to Matrix’s operating agreement

Converted equity includes 1% annual net distribution rights

Security Collateral:

Secured by a Loan, Security, and Exclusive Supply Agreement

Includes assets of GC Franchisee and insurance claims or proceeds tied to borrower assets

Personal Guarantees:

Kerry Sylvester and J.A. Jenkins are jointly and severally liable

Two insurance policies (via Tolbert Corley) act as backup payment in the event of death

Photos: Signed Loan Agreement, 3 Pages

Photo: Graze Craze – Daniel Zier Repayment Schedule

Source: Daniel Zier

Typed-Out Version

THIS CONVERTIBLE AND SECURED PROMISSORY NOTE HAS NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”). THIS INSTRUMENT AND ANY SECURITIES ISSUABLE PURSUANT HERETO HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT, OR UNDER THE SECURITIES LAWS OF CERTAIN STATES. THESE SECURITIES MAY NOT BE OFFERED, SOLD OR OTHERWISE TRANSFERRED, PLEDGED OR HYPOTHECATED EXCEPT AS PERMITTED UNDER THE ACT AND APPLICABLE STATE SECURITIES LAWS PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT OR AN EXEMPTION THEREFROM. CONVERTIBLE AND SECURED PROMISSORY NOTE (this “Note”)

$671,000.00 December 7, 2022 Oklahoma City Oklahoma For value received MATRIX FULFILLMENT LLC (“Borrower”), an Oklahoma limited liability company, with a principal place of business at 525 W. Main Street, Enid, Oklahoma 73701 (registered agent / Matt Davis Law) promises to pay to Tightline Investments LLC, an Oklahoma limited liability company (the “Lender”), or at such other place as Lender may from time to time designate, the principal sum of $780,000 (Seven hundred eighty thousand) together with accrued and unpaid interest thereon, each due and payable on the date and in the manner set forth below with interest of 10%.

Repayment. All payments of interest and principal shall be in lawful money of the United States of America. All payments shall be applied first to accrued interest, and thereafter to principal. Subject to the Lender’s Conversion Rights set forth in Section 3 below, the outstanding principal amount of this Note and all accrued interest hereunder shall be due and payable monthly, without demand, pursuant to the “Amortization Schedule” attached hereto as Exhibit “A” and all remaining principal and accrued interest due hereunder shall be paid in full, without demand, on. The period before the initial payment and the Maturity Date shall be referred to as the “Note Term.”

Interest Rate. The Borrower promises to pay simple interest on the outstanding principal amount hereof from the date hereof until payment in full, which interest shall be payable at the rate of ten percent (10%) per annum. Interest shall be due and payable pursuant to the Amortization Schedule and shall be calculated on the basis of a 365-day year for the actual number of days elapsed.

Conversion and Conversion Procedure. At any time during the Note Term, Lender shall have the right to convert the then-outstanding principal and accrued interest remaining on the Note into membership units of the Borrower equaling twenty percent (63%) of all the Borrower’s then-outstanding membership units (previous contracts combined percentage return) Does not include SBA loan which is separate and assumable guarantee for payment separately by borrower. Principal amount of ($780,000) on a fully diluted basis with $491.40 is total principle plus return less 10% forward “Amortization Schedule” Total is $1,271,400 (only payment by cash unless as adjusted for unit splits, reverse unit splits, units dividends, combinations or the like or cash may include fractional membership units only by mutual agreement of borrower and lender only). In connection with any conversion of this Note into membership units, Lender shall surrender this Note to the Borrower and deliver to the Borrower a customary Release of such units. One such conversion is the 1% of all net distributions will be distributed to lender annually for its full limit of ownership stake in Matrix Fulfillment LLC. This contract supersedes all prior contracts with Graze Craze Inc. or any other entity owned together or separately with any entity directly or indirectly related to Matrix Fulfillment LLC.

Joinder Agreement to the Borrower’s then-current Operating Agreement or Limited Liability Company Agreement (with such amendments and modifications as may be agreed between the Lender and the Borrower). The Borrower shall not be required to issue or deliver the membership units into which this Note may convert until the Lender has surrendered this Note to the Borrower and delivered to the Borrower the customary Joinder Agreement described above.

No Prepayment without Consent. This Note may not be prepaid by the Borrower without Lender’s prior written consent.

Security. This Note and the loan evidenced hereby is secured pursuant to that certain Loan, Security and Exclusive Supply Agreement (the “Security Agreement”) entered between the Borrower, certain Borrower affiliated parties and Lender contemporaneously herewith.

Personal Guaranty. The Borrower’s repayment obligations hereunder are personally guaranteed by Kerry L. Sylvester (“Sylvester”) and J.A. Jenkins (“Jenkins”) pursuant to that certain joint and several “Personal Guaranty” attached hereto as Exhibit “B.” to include farmers insurance agent Tolbert Corley two individual insurance policies as attached personal guarantee for the immediate payment to lender in the event of either or both parties death. Any benefit payment would be considered payment toward this loan and subsequent interest/royalties over time. Any such payment must be recognized as an immediate payment toward principal and interest.

Maturity. Unless this Note has been previously converted in accordance with the terms of Section 3 above, the entire then-outstanding principal balance and all unpaid accrued interest shall become fully due and payable on the Maturity Date.

Expenses. In the event of any default hereunder, the Borrower shall pay all reasonable attorneys’ fees, court costs and litigation expenses incurred by Lender in enforcing and collecting this Note.

Default. If there shall be any “Event of Default” hereunder, at the option and upon the declaration of the Lender and upon written notice to the Borrower (which election and notice shall not be required in the case of an Event of Default under Section 9(9) or 9(i)), this Note shall accelerate and all principal and unpaid accrued interest shall become immediately due and payable. The occurrence of any one or more of the following shall constitute an Event of Default:

(a) the Borrower fails to timely pay any of the principal amount due under this Note on the date the same becomes due and payable or any accrued interest or other amounts due under this Note on the date the same becomes due and payable;

(b) the Borrower shall default in its performance of any covenant under the Note;

(c) the Borrower files any petition or action for relief under any bankruptcy, reorganization, insolvency or moratorium law or any other law for the relief of, or relating to, debtors, now or hereafter in effect, or makes any assignment for the benefit of creditors or takes any corporate action in furtherance of any of the foregoing; or

(d) an involuntary petition is filed against the Borrower (unless such petition is dismissed or discharged within sixty (60) calendar days under any bankruptcy statute now or hereafter in effect, or a custodian, receiver, trustee, assignee for the benefit of creditors (or other similar official) is appointed to take possession, custody or control of any property of the Borrower.Waiver. The Borrower hereby waives demand, notice, presentment, protest and notice of dishonor which may otherwise be applicable under governing law.

Without limiting the generality of the foregoing, all other personal property, goods (including without limitation consumer goods), “farm products”, “documents” (as such terms are defined in the Uniform Commercial Code of the State of Oklahoma as in effect from time to time), credits, claims, demands and assets of GC Franchisee, whether now existing or hereafter acquired from time to time; and

All “Proceeds”, as such term is defined in the Uniform Commercial Code of the State of Oklahoma as in effect from time to time, and in any event shall include, but not be limited to:

(a) any and all proceeds of any insurance, indemnity, warranty or guaranty payable to Lender or GC Franchisee, from time to time, and claims for insurance, indemnity, warranty or guaranty effected or held for the benefit of GC Franchisee, with respect to any of the Collateral (as hereinafter defined);

(b) any and all payments (in any form whatsoever) made or due and payable to GC Franchisee, from time to time in connection with any requisition, confiscation, condemnation, seizure or forfeiture of all or any part of the Collateral by any governmental authority (or any person acting under color of governmental authority); and

(c) any and all other amounts from time to time paid or payable under or in connection with any of the Collateral (all of the foregoing in this subparagraph, collectively, the “Proceeds”); andAny and all additions and accessions to any of the foregoing, all improvements thereto, all substitutions and replacements thereof and all products and Proceeds thereof.

The undersigned confirm that this Schedule is part of a Loan, Security Agreement and Exclusive Supply Agreement signed by them:

GRAZE CRAZE, INCORPORATED

An Oklahoma limited liability company

By: [Signature]

Name: Kerry L. Sylvester

Title: Chief Executive Officer

Date: 12-7-22

By: [Signature]

Name: J.A. Jenkins

Title: Chief Operating Officer

Date: 12-7-22

Lender Tightline Investments LLC

Capt Daniel Zier

Date: 12/7/22

Davis Business Law and Matt Davis Law connections

Davis Business Law also was summoned to speak in December 2022, during the Tom Cook Investments LLC lawsuit against Kerry Sylvester, James Adam Jenkin and Matrix Fulfillment LLC, view here.

Matt Davis Law mentioned in loan agreement.

Matt Davis is the CEO of Davis Business Law.

Screenshot taken from https://davisbusinesslaw.com/about/

Kerry Sylvester passed away in

Google Search Results for DAVIS BUSINESS LAW, PLLC

DAVIS BUSINESS LAW, PLLC